Integration Guide for Monnify BVN Verification

The purpose of this document is to provide a comprehensive and clear set of instructions for developers or businesses integrating Monnify services in accordance with the Central Bank of Nigeria's circular on virtual accounts. This guide will specifically cover BVN verification endpoints, account creation, and updating existing accounts.

Table of Content

- Introduction

- About BVN

- About NIN

- Capturing BVN or NIN for new customers

- Capturing BVN or NIN for old customers

- Fees

Introduction

The Central Bank of Nigeria, released a circular recently, regarding virtual accounts issued to customers, as follows:

Every virtual account must be linked with either a Bank Verification Number (BVN) or National Identification Number (NIN).

For accounts that wish to enjoy the maximum transaction limit, both BVN and NIN must be linked to the Account Number.

Following this update, we would be sharing with you below how to;

- Verify BVN using Monnify BVN Verification endpoints

- How to add BVN during Account Creation / when reserving an Account

- How to Update Existing Account with BVN/NIN

- A Sample Flow / Implementation

About BVN

What is BVN

The Bank Verification Number (BVN) is a unique 11-digit identification number that uniquely identifies an account holder across all banks in Nigeria.

How to get BVN

An account holder can enrol for BVN by visiting any commercial bank branch in Nigeria. For customers who need to remember their BVN info, they can dial the USSD Code 5650# on your number registered with BVN. There is a N20 service charge for checking BVN with USSD

Verification process for BVN

The objective of this step is to verify that the BVN supplied by a customer is correct and that the customer owns this BVN. This process often entails capturing the customer’s BVN and other bank account information, then sharing with a service which confirms the accuracy of this information. There are several services available for this and you can check out Monnify’s BVN verification API

here

About NIN

What is NIN

The National Identification Number (NIN) is your unique 11-digit identifier issued by the National Identification Management Commision (NIMC).

How to get BVN

To get a NIN Number you would be required to provide Original Birth Certificate and Valid Proof of Identity. You can find list of NIMC registration centers and designated enrollment agents on the NIMC website

https://nimc.gov.ng/nimc-enrolment-centres

Verification process for BVN

The objective of this step is to verify that the customer owns this NIN. This step entails capturing the customer’s NIN and other important information and sharing with a service which confirms the accuracy of this information. There are several services available for this and you can check out Monnify’s NIN verification in the Documentation section

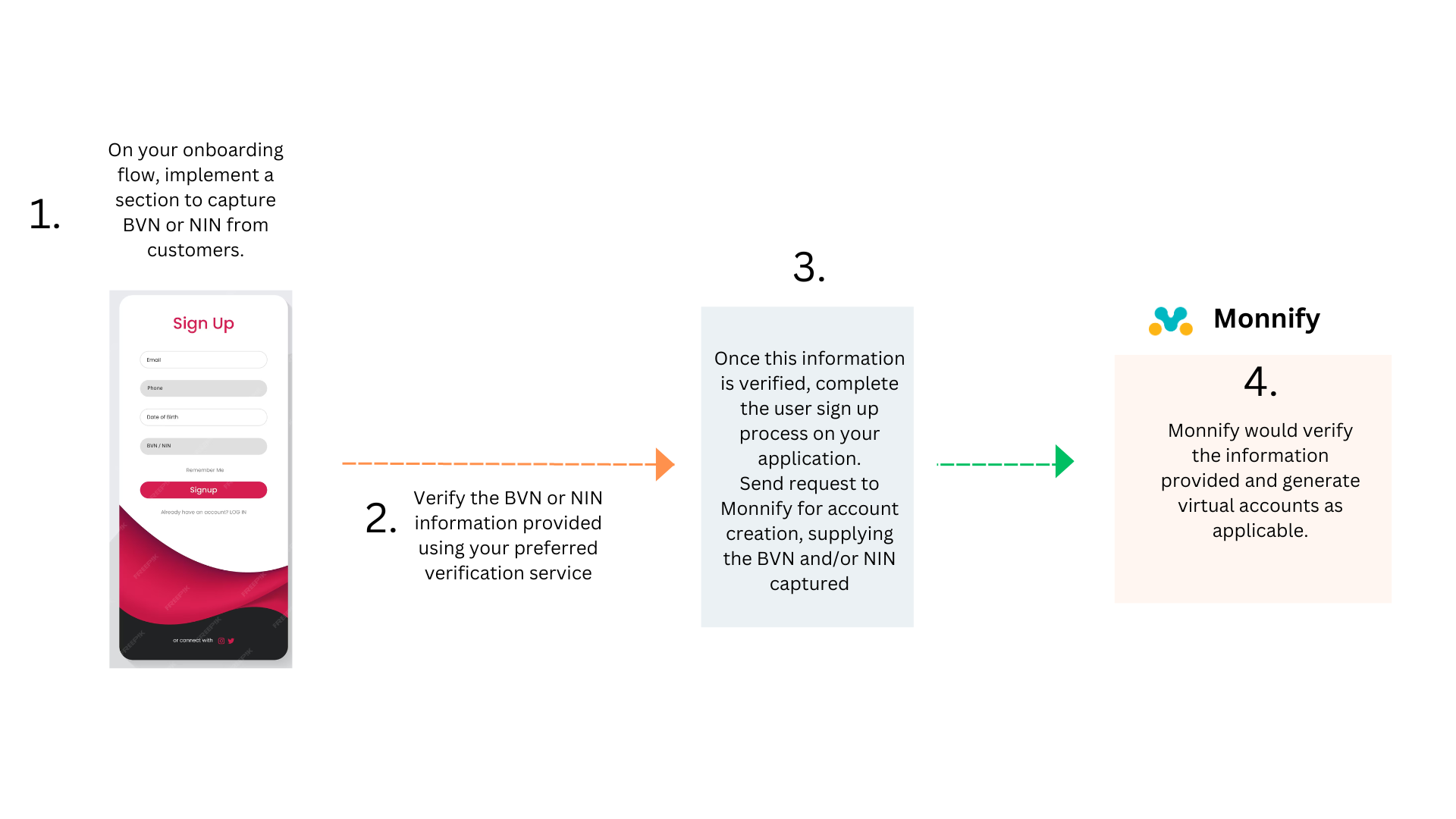

Capturing BVN or NIN for new customers

On your onboarding flow, implement a section to capture BVN or NIN from customers.

Verify the BVN or NIN information provided using your preferred verification service (as indicated in the description sections above)

Once this information is verified, complete the user sign up process on your application.

Send request to Monnify for account creation via this

here

, supplying the BVN and/or NIN captured.

Monnify would verify the information provided and generate virtual accounts as applicable

Save the accounts generated on your system and display them to the customer.

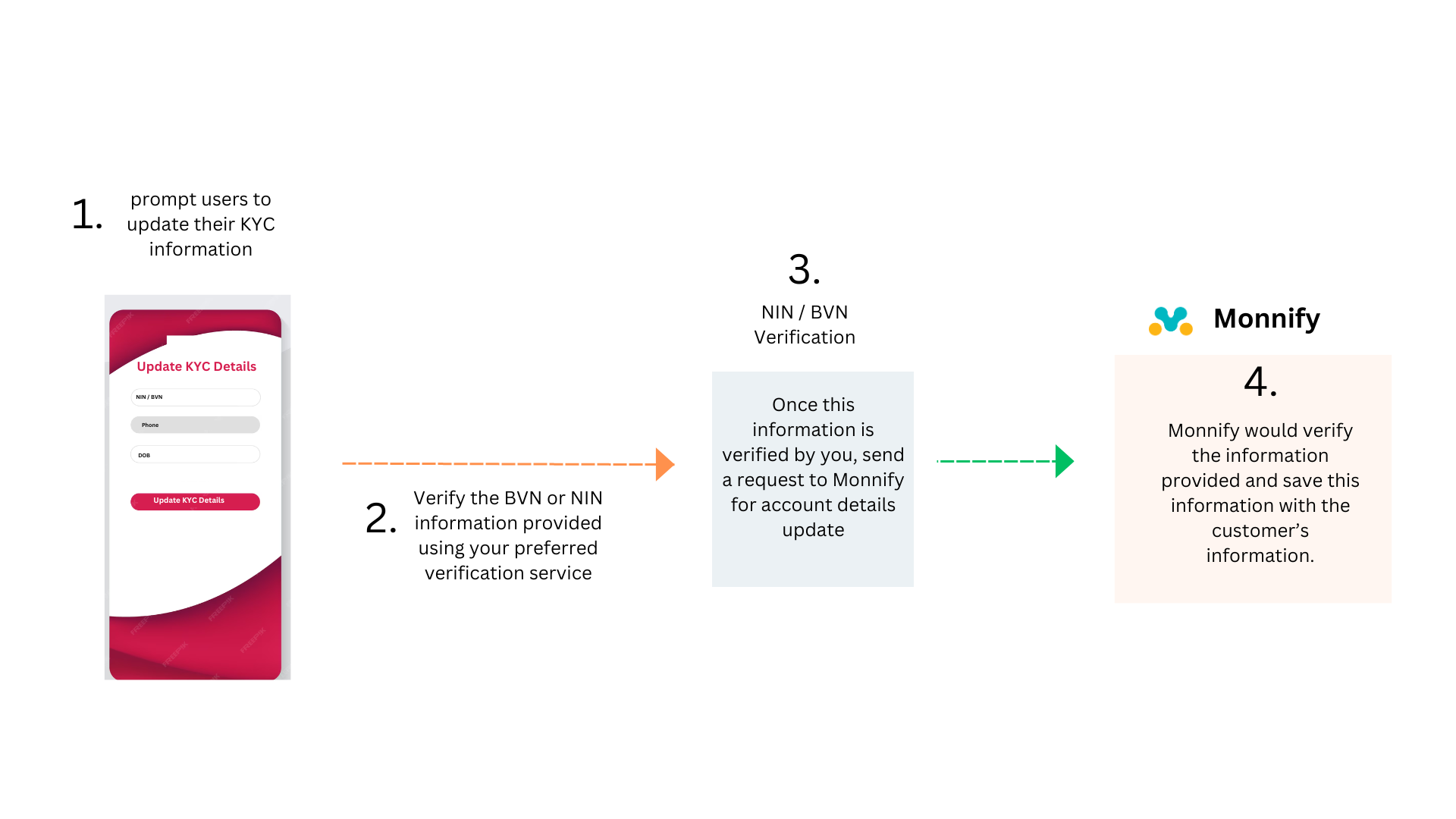

Capturing BVN or NIN for existing customers

On a visible screen within your website or app, implement a notification bar to prompt users to update their KYC information.

On click of this notification bar, display a screen to capture BVN and/or NIN information for the user.

Verify the BVN or NIN information provided using your preferred verification service (as indicated in the description sections above)Once this information is verified by you, send a request to Monnify for account details update via this

https://teamapt.atlassian.net/wiki/spaces/MON/pages/289046549/Reserve+An+Account+V2

, supplying the BVN and/or NIN captured.

Monnify would verify the information provided and save this information with the customer’s information.

On successful response from Monnify, display a message to the user accordingly.

Applicable Fees

Monnify would NOT charge merchants for creating accounts or updating account details with BVN or NIN. Those actions are completely free of charge as usual.

However, to verify BVN / or NIN on a merchant's application, the verification method of choice may attract fees depending on the service being used. This is solely at the discretion of the merchant and not imposed nor charged by Monnify.

Rate this page

How would you rate your experience?